The gaming industry has been a multi-billion dollar business since the 1980s. And it’s easy to see why: Video games can captivate players like few other media can. The dream of making money by spending time in virtual worlds is as old as the industry itself. Computer and video game tournaments and e-sports events have made this dream come true for some exceptionally talented gamers so far.

Rewarding players with money violates gaming tradition

However, video game tournaments and e-sports events are usually sponsored by outside companies, usually multimillion-dollar corporations such as Red Bull, Adidas, and Deutsche Telekom. Computer and video game publishers, on the other hand, rarely sponsor e-sports.

This illustrates the one-sided relationship between gamers and traditional video game development studios. Traditionally, gamers exchange money for entertainment – nothing more. Rewarding the player directly – e.g. for exceptional gameplay or their contributions to the gaming community – is not usually part of the equation. GameFi – occasionally referred to as “Play to Earn” – aims to do away with this one-sided relationship between gamers and development studios.

GameFi aims to make time spent playing games financially worthwhile

GameFi platforms offer their users economic incentives to participate, usually in the form of financial rewards. In traditional computer and video games, rewards have only an ideal value. This is different on GameFi platforms. Rewards are paid in either cryptocurrency or in-game tokens that can be converted to cryptocurrency later. All players need to participate is a wallet to store the cryptocurrency they earn.

The result is an often complex financial system based on blockchain technology and incorporating elements of decentralized finance (DeFi). When it comes to GameFi apps that pay rewards directly in cryptocurrencies, users can also transfer their earnings to other cryptocurrency exchanges and NFT markets. Depending on the ecosystem used, some GameFi apps also offer the opportunity to earn passive income using special features. This is often referred to as “Yield Farming”. Common methods include:

Staking: Users of various DeFi platforms can earn rewards by holding a certain amount of its cryptocurrency for an extended period. The result is similar to interest on a traditional savings account.

Liquidity Mining: Some DeFi platforms allow users to deposit their own capital into their liquidity pool. In return, they receive a share of the platform’s trading fees.

Providers of GameFi platforms benefit from their users’ virtual earnings

A platform that rewards its users for gaming may seem difficult to sustain at first glance. However, GameFi platforms generally have mechanisms in place to ensure that providers directly profit from their users’ earnings.

Transaction fees for digital purchases and sales: GameFi platforms typically charge transaction fees. These fees are charged when users buy, sell, or trade in-game items. The revenue from these fees is used to grow the platform.

Increased demand for platform tokens leads to increased token value: Many GameFi platforms offer their own cryptocurrencies or tokens as a reward for participating in activities. These tokens can be used by users to purchase in-game items. Often, they can also be converted into other cryptocurrencies. The more active users are on the platform, the higher the demand for its tokens, which in turn increases token value.

User retention increases the user base: The ability to earn reliable profits motivates existing users to remain loyal to the platform, which in turn attracts new users. This leads to organic growth of the platform’s user base, making the platform itself progressively more valuable.

The first successful GameFi app appeared in 2017 – and is largely forgotten about today

In 2017, CryptoKitties made waves – a GameFi platform where participants can collect, breed, and trade digital cats. CryptoKitties is based on the Ethereum blockchain and quickly gained popularity. In 2018, CryptoKitties reached the milestone of more than 32.2 million transactions. However, since 2022, the app’s popularity has declined significantly. The digital felines, which were often worth over $100,000 shortly after the app’s release, now sell for digital pocket change.

Source: YouTube / CryptoKitties

Dapper Lab, the development studio behind CryptoKitties, recently acknowledged numerous shortcomings of the platform: CryptoKitties was the world’s first game on the Ethereum blockchain, which lead to unsustainable hype and inflated value of the digital kittens being sold.

CryptoKitties’ digital ecosystem also proved to be flawed. As the number of digital cats in circulation was unlimited, demand quickly declined. In addition, the transaction fees on the Ethereum blockchain proved to be too high. Finally, it became clear that CryptoKitties offered little entertainment value beyond the financial incentive.

The most successful Game-Fi apps in early 2024

3. Legends Reborn: Age of Chance (Trading volume: $331.25 million)

Legends Reborn: Age of chance is a strategic card game where players from around the world compete against each other in 1v1 battles. Each card in the players’ card deck is assigned to a fantasy creature with character attributes and different strengths and weaknesses. Battles play out in a fashion similar to computer role playing games and the player with the stronger card deck wins. Players can not only buy cards for their deck but also NFTs and digital land. Legends Reborn: Age of Chance uses several virtual currencies that can be exchanged for the cryptocurrency Ethereum.

2. Axie Infinity (Trading volume: $1.06 billion)

In this GameFi app, players breed and collect fantasy creatures called Axie, which resemble Pokemon. They can collect, breed, trade, and fight Axies. In doing so, they can earn various rewards. The app uses several virtual currencies that can be exchanged for the cryptocurrency Ethereum. In addition, virtual properties can be bought and rented.

The controversy surrounding Axie Infinity

The second most popular GameFi app in 2024 has become quite controversial. In order to get started and earn money by breeding virtual monsters, players are required to purchase at least three Axies. High-quality Axies with well-balanced character attributes can cost up to 1000 USD.

The platform allows users to borrow Axies from other players. In return, those who lend their Axies to other users receive a share of their income. This share is not regulated by the platform. According to reports, scammers abuse this feature by lending a large number of Axies to inexperienced users and demanding excessive profit shares.

In 2022, $600 million worth of cryptocurrency was stolen after a hacking attack on the platform. Shortly after, Trung Nguyen, CEO of the platform’s publisher, made headlines thanks to famous crypto YouTuber Asobs. Asobs caught Nguyen transferring $3 million worth of cryptocurrency to the Binance crypto exchange shortly after the hack became public.

1. The Sandbox (Trading volume: $1.29 billion)

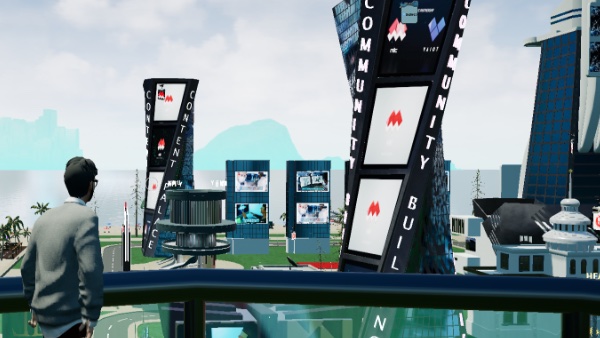

Unlike the previous two popular GameFi apps, The Sandbox is a metaverse platform with a 3D world that participants can explore using customizable avatars. The platform features an integrated financial system based on the Ethereum blockchain. One of the most popular GameFi features of The Sandbox is buying and building digital land.

On this land, platform users can create their own NFTs. These can take the form of buildings, but also self-created games. Possible games are obstacle courses or opponents to defeat. Both the purchased land and the created NFTs can be sold. Items traded on The Sandbox are known to be worth up to millions of US dollars.

Is the hype surrounding GameFi justified?

GameFi is still in its infancy – and therefore has various weaknesses. The overblown hype surrounding CryptoKitties and the abuse-prone infrastructure of Axie Infinity are obvious examples. In addition, the long-term viability of GameFi platforms that prioritize economic incentives over enjoyable gameplay is still hotly debated among experts.

The metaverse’s decentralized structure will integrate GameFi platforms directly

Online platforms with optional participation in the financial ecosystem appear to be more future-proof. A popular example is The Sandbox, which has been active for more than ten years. In addition, The Sandbox and similar platforms – such as the MILC Metaverse – come closest to the decentralized metaverse concept, which is shaping up to be the future of the Internet.

According to experts, the metaverse will be characterized by the integration of features and services of all kinds – from digital shopping malls to virtual search engines – into an open, decentralized infrastructure. Services from tech giants like Meta and Google will no longer be walled gardens, but will coexist.

This structure will replace the current Web 2.0, which is dominated by self-contained sites and online platforms. A decentralized online world will also be able to accommodate different types of GameFi services. It will be interesting to see how GameFi will evolve from there.